ONLINE LOANS WITH MONTHLY PAYMENTS PHILIPPINES: TOP OPTIONS FOR FILIPINOS

Do you want hassle-free online loans with monthly payments in the Philippines? Click on this post to discover flexible options tailored to your needs now!

Have you ever considered the convenience and flexibility of online loans with monthly payments in the Philippines? In today's world, having access to quick and reliable financial solutions is more important than ever. Dive into this post to discover how this service can help you achieve your goals while maintaining financial stability!

Top 5 Online Loans with Monthly Payments in the Philippines

If you are seeking the best options for top online loans with monthly payments in the Philippines, check the list of reliable lenders below:

MoneyCat

MoneyCat offers a unique blend of convenience and reliability, catering to various financial needs with flexible loan options. It is designed to be accessible even to those with minimal credit history, making it a viable choice for many Filipinos. The standout feature of MoneyCat is its commitment to customer service. The platform offers 24/7 support, ensuring borrowers can get assistance whenever needed

Interest rate: 1.12% - 1.95% per month

Loan amount: ₱500 - ₱20,000

Repayment period: up to 6 months

Pros:

- 0% interest rate for new borrowers

- User-friendly platform

- Excellent customer support

Cons:

- Interest rates can vary

- Relatively high interest rate

Finbro

Finbro is a reputable online lending platform known for its user-friendly approach and transparent processes. It aims to provide quick and easy loan access to Filipinos, especially those who might not qualify for traditional bank loans. Besides, the platform has highly responsive customer service, which provides support throughout the loan application and repayment periods.

Interest rate: 1.5% - 3% per month

Loan amount: ₱1,000 to ₱50,000

Repayment period: up to 12 months

Pros:

- No collateral required

- Flexible repayment terms

- No interest rate for a new loan

Cons:

- Requires good credit standing for best rates

- Charge for processing fees

CREZU

CREZU is a well-known online lending service that addresses various financial requirements in the Philippines. It boasts a user-friendly interface and a swift approval process. Borrowers can apply for a loan and receive funds in a few hours, making it ideal for urgent situations.

Interest rate: 2% - 4% per month

Loan amount: ₱1,000 - ₱25,000

Repayment period: up to 4 months

Pros:

- Fast approval

- Simple application process

- 0% interest rate for first-time borrowers

- No service fees

Cons:

- High daily interest rates

- Short repayment period

Cashspace

Cashspace is another prominent player in the online loan market in the Philippines. What sets this platform apart is its commitment to transparency and customer satisfaction. It provides detailed information about fees upfront and ensures that all terms and conditions are clearly presented to the borrower, eliminating hidden fees or surprises.

Interest rate: 2% - 4% per month

Loan amount: ₱1,000 - ₱25,000

Repayment period: up to 4 months

Pros:

- 0% interest rate for the first loan

- Transparent fee structure

- Flexible loan amounts

- No hidden charges

Cons:

- Still relatively high interest rates

- Requires more documentation

Cashspace

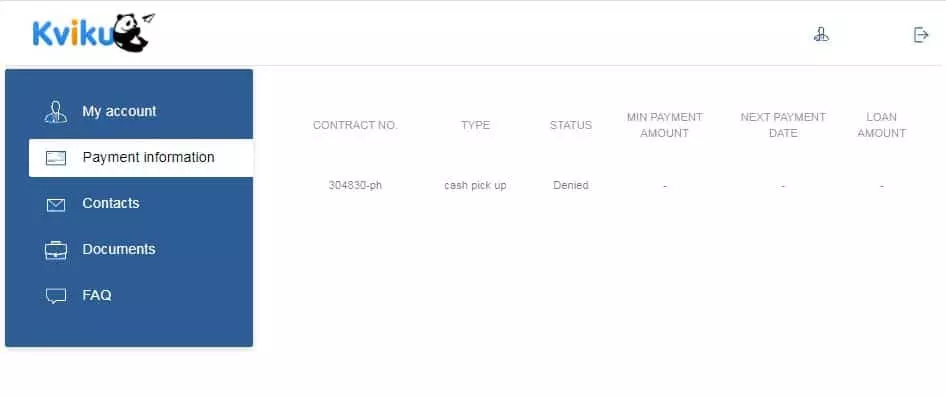

Kviku

Kviku is known for its seamless application process and favorable terms. It differentiates itself through its transparent fee structure and competitive rates. The platform is committed to providing clear and concise information to borrowers, ensuring no hidden fees or charges. Additionally, Kviku's repayment terms are designed to be borrower-friendly, making it easier for users to manage their repayments.

Interest rate: 2% - 4% per month

Loan amount: ₱5,000 - ₱50,000

Repayment period: up to 6 months

Pros:

- Transparent fee structure

- User-friendly interface

- Easy application process

Cons:

- Stringent eligibility requirements

- Relatively high monthly interest rates

Kviku

Benefits of Online Loans with Monthly Payments

Online loans with monthly payments offer numerous advantages for Filipinos seeking financial assistance, including:

Manageable Payments

Monthly payments allow borrowers to budget their finances effectively, ensuring they can meet their loan obligations without undue strain on their monthly income. For instance, if you take out a loan for home renovation, spreading the cost over several months makes it more affordable and less burdensome than lump-sum payments.

Instant approval decision

Another significant advantage is the quick approval process. Traditional loans often involve lengthy paperwork and extended waiting periods, which can be inconvenient during emergencies. On the other hand, online loans provide instant approval decisions. Many online lenders use advanced algorithms to assess creditworthiness in real time, enabling applicants to receive approval within minutes. This swift process is beneficial for those who need immediate funds.

Instant approval process

Variety of Loan Amounts

Online lenders in the Philippines offer various loan amounts, catering to different requirements. Whether you need a small amount to cover minor expenses or a larger sum for significant investments, you can choose the best-suited one for your financial needs. For instance, some platforms allow borrowers to take out loans from ₱5,000 to ₱1,000,000. This flexibility ensures that users can find a loan option that matches their requirements.

Flexible repayment options

Flexibility in repayment options is another benefit of online loans with monthly payments. Borrowers are often given the choice to customize their repayment schedule according to their financial situation. Some lenders allow early repayments without penalties, while others offer the option to extend the repayment period if needed. This adaptability is helpful for individuals with fluctuating incomes, such as freelancers or seasonal workers.

Accessibility for Poor Credit History

One of the most inclusive aspects of online loans with monthly payments is their accessibility to individuals with bad credit. Traditional banks are often stringent about credit scores, making it difficult for those with less-than-perfect credit to secure a loan. However, online lenders tend to have more lenient requirements, focusing instead on current financial stability and repayment ability. This inclusivity ensures that more Filipinos can access much-needed financial assistance, regardless of their past credit issues.

Accessibility for poor credit history

Conclusion

Online loans with monthly payments in the Philippines present numerous benefits, but you must choose the right option, depending on your needs and preferences. Consider the top 5 platforms in this post and carefully weigh their pros and cons to find the best fit for your financial situation.